Patek Philippe Unveils 11 Unique New Alliances of Technical Prowess and Style at Watches & Wonders 2024.

Patek Philippe 2024 Novelties

Patek Philippe Unveils 11 Unique New Alliances of Technical Prowess and Style at Watches & Wonders 2024.

Patek Philippe Unveils 11 Unique New Alliances of Technical Prowess and Style at Watches & Wonders 2024.

Patek Philippe Unveils 11 Unique New Alliances of Technical Prowess and Style at Watches & Wonders 2024.

Cartier’s iconic square watch.

NORQAIN embodies Swiss craftsmanship beyond mere "Swiss made" inscriptions on watch dials with their expertise spanning over four decades in the watch industry.

Discover more301

Created to meet the challenge of prolonged underwater missions, the Sea-Dweller is the... [:en]Rolex created the Oyster Perpetual Sea-Dweller in 1967 to meet the challenge of prolonged underwater missions. The Sea-Dweller is specifically designed for saturation diving. Thanks to its... Created to meet the challenge of prolonged underwater missions, the Sea-Dweller is the watch of choice for those braving the unknown depths and unbearable pressure. Discover the collection at Cortina...

Blancpain unveils its new 42 mm-diameter Fifty Fathoms Automatique models. Blancpain unveils its new 42 mm-diameter Fifty Fathoms Automatique models. After presenting its first case of this size in steel on last year’s Fifty Fathoms 70thAnniversary Act 1 limited edition,... Blancpain unveils its new 42 mm-diameter Fifty Fathoms Automatique models.

The recent Watches and Wonders Geneva saw a record 54 brands reveal their latest... The recent Watches and Wonders Geneva saw a record 54 brands reveal their latest horological innovations. The highly anticipated event catered to the press and retailers from April 9 to 12, while... The recent Watches and Wonders Geneva saw a record 54 brands reveal their latest horological innovations.

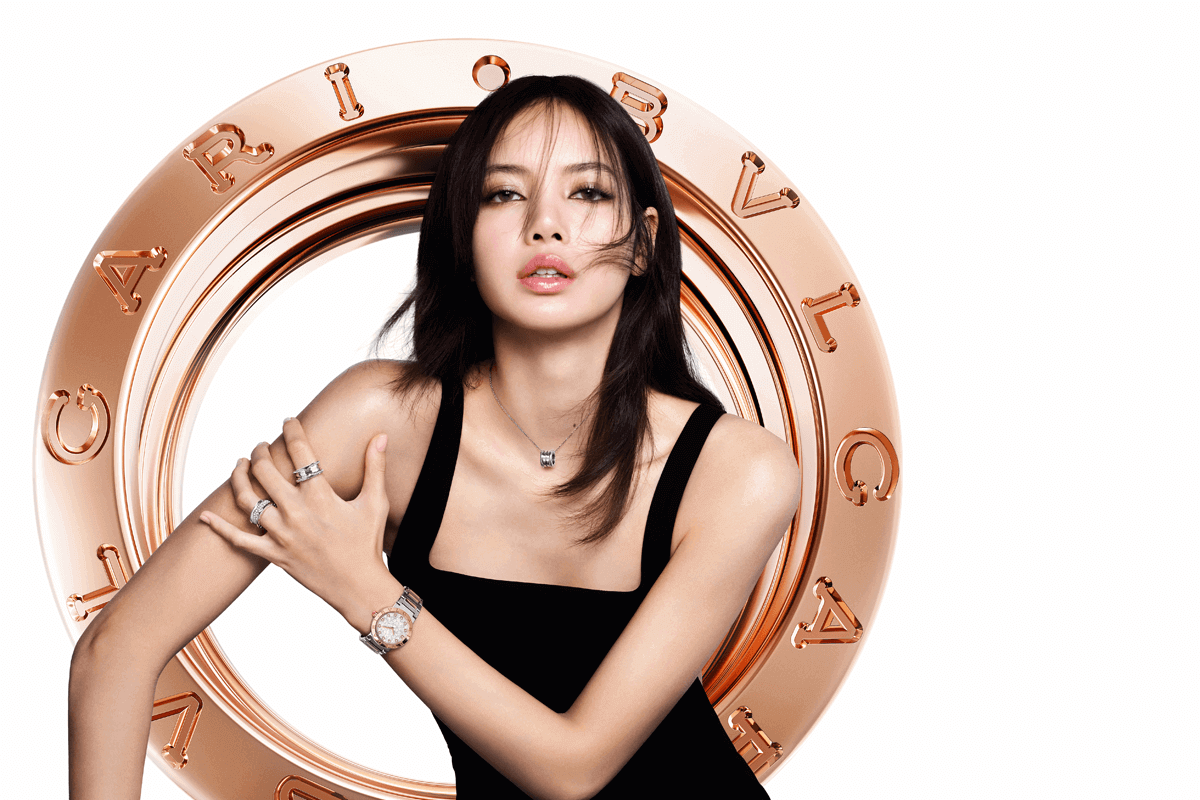

Bulgari is pleased to announce its Geneva Springtime 2024 collection, featuring exciting... Bulgari is pleased to announce its Geneva Springtime 2024 collection The Collection features exciting collaborations and limited edition timepieces from the Roman Maison’s celebrated Serpenti,... Bulgari is pleased to announce its Geneva Springtime 2024 collection, featuring exciting collaborations and limited edition timepieces from the Roman Maison’s celebrated Serpenti, Octo Finissimo...

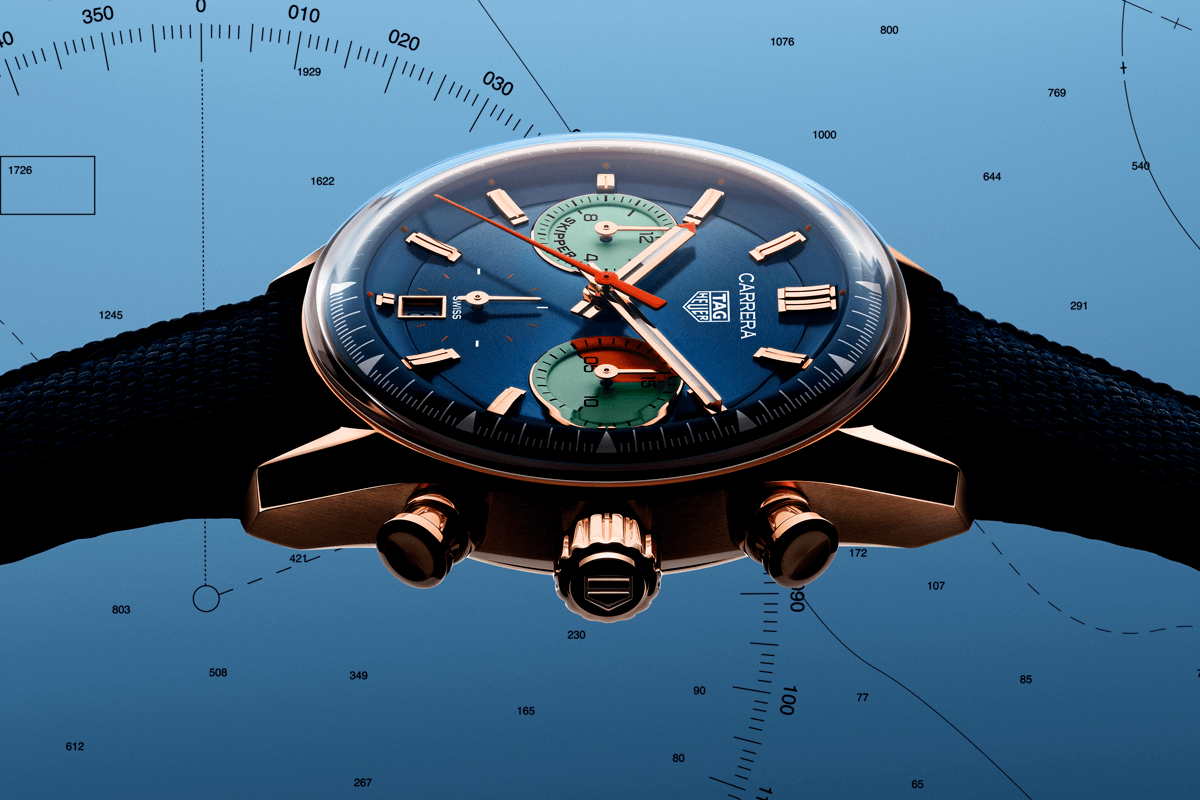

TAG Heuer refreshes its Carrera and Monaco collections with addition of several new models... TAG Heuer refreshes its Carrera and Monaco collections with addition of several new models during the Watches and Wonders Geneva 2024. Following a welcome return to the world of yachting with last... TAG Heuer refreshes its Carrera and Monaco collections with addition of several new models during the Watches and Wonders Geneva 2024.

Grand Seiko refreshes its collections with these three timepieces. Grand Seiko refreshes its collections with these three timepieces. Evolution 9 Collection - SLGW003 [caption id="attachment_111619" align="aligncenter" width="1000"] The new dress watch features a... Grand Seiko refreshes its collections with these three timepieces.

A luminous watch that is much more than a timepiece, the Tonda PF Micro-Rotor Golden Siena... Introducing the beauty in its purest form: Parmigiani Fleurier Tonda PF Micro-Rotor No Date Tonda PF Micro Rotor Siena “In the creation of the new Tonda PF Micro-Rotor No Date, we endeavored to... A luminous watch that is much more than a timepiece, the Tonda PF Micro-Rotor Golden Siena exemplifies watchmaking sophistication, imbued with the serenity that makes discreet refinement the ultimate...

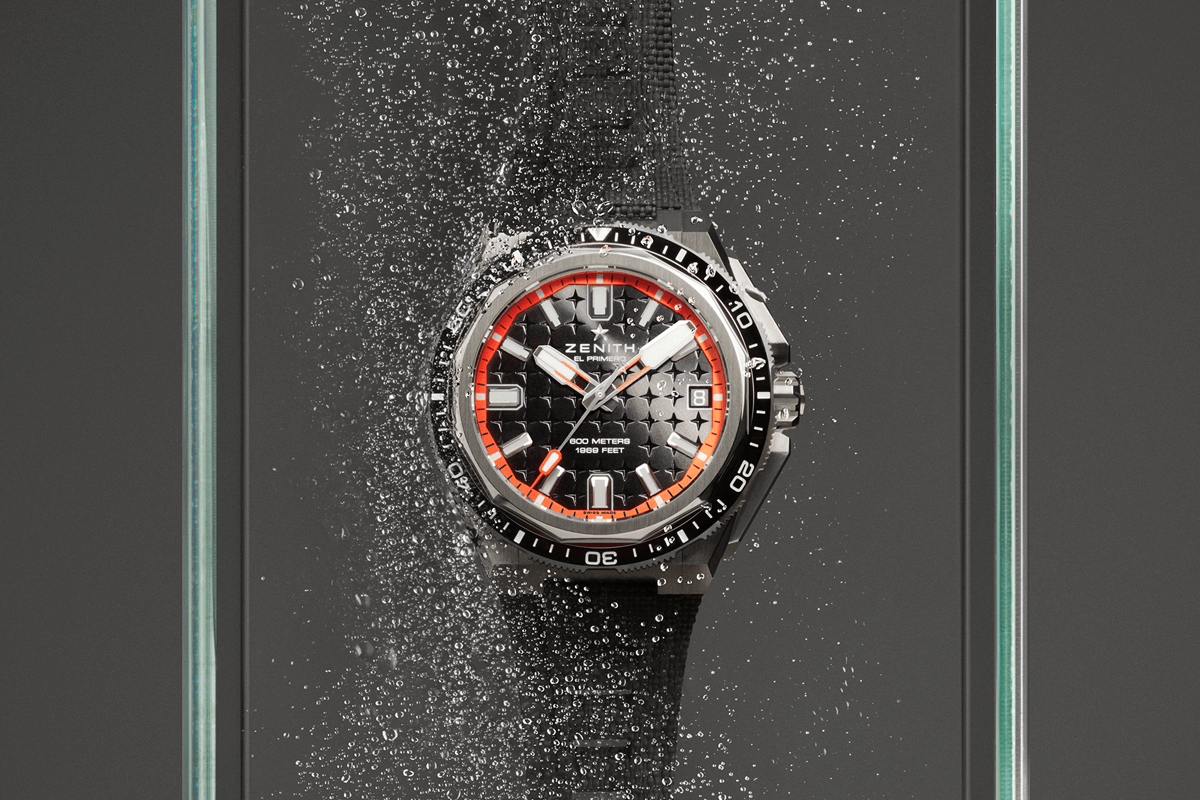

Since its inception in 1969, the ZENITH DEFY line of wristwatches has been all about... Since its inception in 1969, the ZENITH DEFY line of wristwatches has been all about steadfast reliability and ruggedness. Throughout the years, the DEFY has taken on many iterations with... Since its inception in 1969, the ZENITH DEFY line of wristwatches has been all about steadfast reliability and ruggedness.

“Cartier, the subtle magician, who dangles slivers of the moon on a thread of sun...”... “Cartier, the subtle magician, who dangles slivers of the moon on a thread of sun...” - Jean Cocteau Playing with shapes, crossing the border between the real and the imaginary or stepping... “Cartier, the subtle magician, who dangles slivers of the moon on a thread of sun...” - Jean Cocteau

Chopard refreshes its collections with addition of several new models, revealed during the... Chopard refreshes its collections with addition of several new models, revealed during the Watches and Wonders Geneva 2024. Alpine Eagle XL Chrono The Alpine Eagle collection of sporty-chic... Chopard refreshes its collections with addition of several new models, revealed during the Watches and Wonders Geneva 2024.

The new black ceramic pieces from Bell & Ross have three distinct models: two that become... With impressive technical properties such as complete resistance to scratches, ceramic has become a key material in watchmaking. Paired with the intensity of black, the material becomes a direct... The new black ceramic pieces from Bell & Ross have three distinct models: two that become a part of the brand’s permanent collections, and the third piece being a limited edition of 500 pieces.

NORQAIN introduces a world premiere: the Wild ONE of 1, a luxury mechanical watch with 3.5... NORQAIN introduces a world premiere: the Wild ONE of 1, a luxury mechanical watch with 3.5 million possible configurations. NORQAIN, the family-owned independent Swiss watch company, is proud to... NORQAIN introduces a world premiere: the Wild ONE of 1, a luxury mechanical watch with 3.5 million possible configurations.

A killer lime green dial, a totally lit rubber strap: the H. Moser & Cie. Pioneer Centre... A killer lime green dial, a totally lit rubber strap: the H. Moser & Cie. Pioneer Centre Seconds Concept Citrus Green model is more than just a watch. Designed for those who don't want to be... A killer lime green dial, a totally lit rubber strap: the H. Moser & Cie. Pioneer Centre Seconds Concept Citrus Green model is more than just a watch.

Being bold can take many forms. Originally made together with Jay Chou and now released to... Being bold can take many forms. Originally made together with Jay Chou and now released to the public this new version of the Black Bay Chrono celebrates the daring spirit of the TUDOR... Being bold can take many forms. Originally made together with Jay Chou and now released to the public this new version of the Black Bay Chrono celebrates the daring spirit of the TUDOR ambassadors.

Breitling honors its aviation and space icons with an array of releases: the Navitimer GMT... Breitling honors its aviation and space icons with an array of releases: the Navitimer GMT and Automatic 41, and a limited-edition self-winding Cosmonaute. Sports superstars Erling Haaland and... Breitling honors its aviation and space icons with an array of releases: the Navitimer GMT and Automatic 41, and a limited-edition self-winding Cosmonaute.

Combining performance and style, Longines HydroConquest watches are designed for those who... This year, the Longines HYDROCONQUEST GMT line has been enhanced with new models with 43 mm diameter cases. Water-resistant up to 30 bar (300 metres), robust, and with a unidirectional rotating... Combining performance and style, Longines HydroConquest watches are designed for those who love pushing back boundaries and exploring new horizons.

Already renowned as the most iconic chronograph on Earth, the OMEGA Speedmaster Moonwatch... Already renowned as the most iconic chronograph on Earth, the OMEGA Speedmaster Moonwatch is launched in its newest edition – this time with a lacquered white dial inspired by space exploration and... Already renowned as the most iconic chronograph on Earth, the OMEGA Speedmaster Moonwatch is launched in its newest edition.

Swiss watch brand TUDOR celebrated the official opening of its largest boutique in... Swiss watch brand TUDOR celebrated the official opening of its largest boutique in Malaysia, in partnership with leading watch retailer Cortina Watch, on 14 March 2024. Located in Pavilion Damansara... Swiss watch brand TUDOR celebrated the official opening of its largest boutique in Malaysia, in partnership with leading watch retailer Cortina Watch, on 14 March 2024.

The OMEGA Constellation collection has long been inspired by the precise movement of the... The OMEGA Constellation collection has long been inspired by the precise movement of the stars. This year, that stellar theme continues with a new range of models featuring distinctly unique dials... The OMEGA Constellation collection has long been inspired by the precise movement of the stars.

Now Parmigiani Fleurier introduces a new Tonda PF Hijri Perpetual Calendar in a stainless... Parmigiani Fleurier Tonda PF at the forefront of calendar complications At Parmigiani Fleurier we proudly assert our position as a pioneer in the delicate and historically rooted art of calendar... Now Parmigiani Fleurier introduces a new Tonda PF Hijri Perpetual Calendar in a stainless steel case with a vivid Viridian green dial.

Renowned for precision and adventure, NORQAIN’s timepieces are in a unique position with... Renowned for precision and adventure, NORQAIN’s timepieces are in a unique position with their own distinct character. They feature exclusive mechanical movements and distinctive design elements.... Renowned for precision and adventure, NORQAIN’s timepieces are in a unique position with their own distinct character.

A new star in the DEFY Skyline constellation is born. The ZENITH Manufacture incorporates... A new star in the DEFY Skyline constellation is born. The ZENITH Manufacture incorporates a new automatic high-frequency tourbillon calibre into the DEFY Skyline Tourbillon, in two versions in... A new star in the DEFY Skyline constellation is born. The ZENITH Manufacture incorporates a new automatic high-frequency tourbillon calibre into the DEFY Skyline Tourbillon, in two versions in steel...

In a new iteration of the iconic BR 03 diver, Bell & Ross has chosen to combine a bronze... In a new iteration of the iconic BR 03 diver, Bell & Ross has chosen to combine a bronze case with a brilliant green dial in the BR 03-92 Diver Black & Green Bronze. Exploring the deep sea demands... In a new iteration of the iconic BR 03 diver, Bell & Ross has chosen to combine a bronze case with a brilliant green dial in the BR 03-92 Diver Black & Green Bronze.

ZENITH unveils the lightest iteration of its award-winning 1/10th of a second with the... Ahead of the opening matches of Patrick Mouratoglou’s UTS 2024 season, which ZENITH proudly continues its role as Official Timekeeper, ZENITH unveils the lightest iteration of its award-winning... ZENITH unveils the lightest iteration of its award-winning 1/10th of a second with the Chronomaster Sport Titanium – along with a new range of integrated rubber straps.

By joining forces once again, the global artist and Roman Jeweller introduce a brilliant... LISA - a muse, a symbol in today’s world. Bulgari Bulgari – a timeless and powerful icon. By joining forces once again, the global artist and Roman Jeweller introduce a brilliant collaboration... By joining forces once again, the global artist and Roman Jeweller introduce a brilliant collaboration - BULGARI BULGARI X LISA LIMITED EDITION: daring, dazzling, precious and modern.

The leading retailer and distributor of luxury timepieces aims to enhance customer care... The leading retailer and distributor of luxury timepieces aims to enhance customer care and extend its dedication to outstanding after-sales service with the introduction of Horology... The leading retailer and distributor of luxury timepieces aims to enhance customer care and extend its dedication to outstanding after-sales service with the introduction of Horology Services.

TAG Heuer, the Swiss luxury watchmaker, unveils the Aquaracer Solargraph, Carrera... TAG Heuer, the Swiss luxury watchmaker, unveils the Aquaracer Solargraph, Carrera Chronograph, and Carrera Date Plasma Diamant d’Avant-Garde with yellow diamonds in the LVMH Watch Week at... TAG Heuer, the Swiss luxury watchmaker, unveils the Aquaracer Solargraph, Carrera Chronograph, and Carrera Date Plasma Diamant d’Avant-Garde with yellow diamonds in the LVMH Watch Week at Miami.

The long-awaited ZENITH triple calendar chronograph makes its grand return at LVMH Watch... The long-awaited ZENITH triple calendar chronograph makes its grand return – and its sharper than ever before. Chronomaster Original Triple Calendar One of the most emblematic variations of the... The long-awaited ZENITH triple calendar chronograph makes its grand return at LVMH Watch Week – and its sharper than ever before.

At LVMH Watch Week 2024, the radiant glow of this exquisite metal elevates the daring... Eternal and precious, gold has been a hallmark element of Bulgari since the Art Deco era, intricately woven into the fabric of its audacious horological narrative. At LVMH Watch Week 2024, the... At LVMH Watch Week 2024, the radiant glow of this exquisite metal elevates the daring classicism of Bulgari Bulgari, reveals the jeweled splendor of Lucea, and infuses the revolutionary elegance of...

Every timepiece has its own distinct personality. What’s yours? Take our connoisseur quiz to find the perfect watch to match your lifestyle.

Start the quizOur team is happy to answer your questions. Fill in the form and we'll be in touch as soon as possible

We use cookies for some of the website features to provide the best experience. By using our site, you agree to our usage of cookies. LET ME CHECK

The form was submitted successfully, and we will contact you shortly.

Explore Watch Brands